The Stock Market Has Reached Bottom

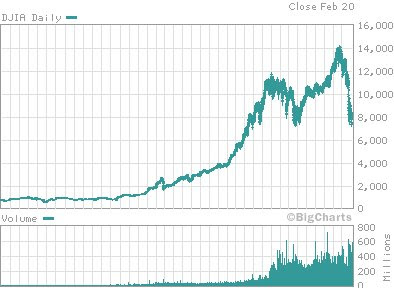

This is a chart of the Dow for the last 25 years.

Note the steady line for the first half, then the slight steady rise. That rise is the beginning of the computer age when our actual productivity began to increase..

Note the large rise a few years later. This is when computers allowed speculation in an instant market that wasn't possible before.

Note the first "crash" when that speculation bubble burst. That was the effect of the attack on 9-11.

Note the next rise, based solely on speculation driven by the new ability of individuals to invest directly in the market with online brokerages.

Note the current crash. The bottom of the current crash is at the same point as the bottom of the last crash. The new bottom is along a line you can draw from the point just before the first speculation.

This line would be the natural linear growth of our productivity due to ongoing improvements in technology. It is not an unsustainable exponential curve, but a straight sustainable bottom line.

Conclusion, the market has reached its real value for the first time since the market had first become overinflated due to speculation. Though it may drop a bit more due to inertia and uncertainty, it must snap back because productivity efficiency is its natural base.

Note the steady line for the first half, then the slight steady rise. That rise is the beginning of the computer age when our actual productivity began to increase..

Note the large rise a few years later. This is when computers allowed speculation in an instant market that wasn't possible before.

Note the first "crash" when that speculation bubble burst. That was the effect of the attack on 9-11.

Note the next rise, based solely on speculation driven by the new ability of individuals to invest directly in the market with online brokerages.

Note the current crash. The bottom of the current crash is at the same point as the bottom of the last crash. The new bottom is along a line you can draw from the point just before the first speculation.

This line would be the natural linear growth of our productivity due to ongoing improvements in technology. It is not an unsustainable exponential curve, but a straight sustainable bottom line.

Conclusion, the market has reached its real value for the first time since the market had first become overinflated due to speculation. Though it may drop a bit more due to inertia and uncertainty, it must snap back because productivity efficiency is its natural base.

Comments